testing 2

One Person is Facing Charges after Failed Traffic Stop in Blount County Ends in a Police Chase and Crash

One person is facing charges following a police chase after a failed traffic stop in Blount County.

The Blount County Sheriff’s Office confirmed a crash on Chapman Highway Friday night started as a traffic stop Old Knoxville Highway near Sam Houston School Road because deputies were suspicious the car was stolen.

30-year-old Joshua Mayes, refused to pull over, prompting the chase and crashed into another car head-on near Chapman Highway and Governor John Sevier Highway.

Mayes was taken into custody and charged with two counts of vehicular assault, DUI and aggravated assault.

Two passengers and the driver of the other car involved in the crash were injured. The Tennessee Highway Patrol says Mayes is the only person facing charges.

Rock the Country Music Festival to Have Major Impact on Blount County Traffic

Greenback, TN (WOKI) The Blount County Sheriff’s Office is warning of major traffic delays near Maple Lane Farms as the Rock the Country Music Festival rolls into town this weekend.

The sheriff’s office says the festival is expected to bring between 12 and 15 thousand people to Greenback.

Officials remind you that traffic will be impacted in and around the area of Maple Lane Farms beginning Thursday, April 24 and continuing through Sunday, April 27 as big name performers including Nickelback, Kid Rock and Lynard Skynyrd draw crowds to the area.

The Blount County Sheriff’s Office also provided a map via social media detailing the traffic pattern into and around the venue, including where deputies will be stationed (see below).

Additionally, Sheriff James Lee Berrong reminds all festival goers of the office’s “zero tolerance” policy when it comes to those who decide to break the law while at the festival.

“Sheriff Berrong would like to remind festival goers to have a good time while staying safe and exhibiting good citizenship,” the post said. “There will be a zero-tolerance policy in place for attendees who do not abide by the law and who refuse to use common sense.”

Missionary Pastor from Maryville Church Kidnapped in South Africa is Rescued Following Shootout

Multiple media outlets reporting that Josh Sullivan, the pastor from Maryville that was abducted in South Africa is now safe.

According to a statement from the “Hawks,” a specialized police unit that investigates crimes, several police agencies went to a house and found Sullivan in a car.

The suspects in the car reportedly tried to flee and opened fire on the police. The officers shot and killed three of the suspects and were able to rescue Sullivan.

The Hawks say he is “miraculously unharmed” and in excellent condition.

This story comes courtesy our news partner Fox News https://www.foxnews.com/: Authorities in the Eastern Cape Province of South Africa rescued a kidnapped American pastor during a deadly shootout on Tuesday at a house in KwaMagxaki, Gqeberha.

The Directorate for Priority Crime Investigation (HAWKS) released a statement announcing that an operation led by the agency “resulted in the successful rescue” of an American pastor who was kidnapped.

Though the news release did not name the pastor, 34-year-old Josh Sullivan, of Tennessee, was kidnapped by several armed, masked men last week at his church in the Eastern Cape, Fellowship Baptist Church Motherwell.

American pastor Josh Sullivan, who was kidnapped from his church in the Eastern Cape Province last week, has been rescued by police following a “high-intensity shootout.” (Fellowship Baptist Church/Facebook)

Police said they received tips that Sullivan was inside a safe house in KwaMagxaki, Gqeberha.

When they arrived at the home, suspects inside a car on the premises began firing at law enforcement and attempted to flee.

A “high-intensity shootout” took place and three unidentified suspects were killed.

Sullivan was found inside the same car that the suspects were in, but he was “miraculously unharmed,” police said, adding that he is “currently in an excellent condition.”

Josh Sullivan is from Maryville, Tennessee, and spent years observing the leadership of Fellowship Baptist Church Pastor Tom Hatley, according to congregation members on Facebook. (Facebook)

Tom Hatley, pastor of Fellowship Baptist Church in Maryville, Tennessee, confirmed Sullivan’s rescue early Wednesday morning in a Facebook post.

“Josh has been released. I just got ‘the go ahead to let it be known’. SA media has started broadcasting. American media will follow. Thank you for your support and prayers. Please do not stop praying for The Sullivans. Praise The Lord Jesus Christ!” he wrote.

Sullivan is from Maryville and spent years learning how to be a pastor under Hatley’s leadership, according to congregation members on Facebook.

Sullivan went to South Africa with his wife and two children in 2018 after the couple participated in a six-month internship there in 2015 as part of their Bible training to become missionaries.

Josh Sullivan, an American pastor from Tennessee, has been working as a missionary in South Africa with his wife and their children since 2018. (Fellowship Baptist Church Motherwell/Facebook)

“It was during this time that the Lord began to stir their hearts specifically for the Xhosa people,” fellow Missionary Mark Coffey said. “They returned in 2018 as full-time church-planting missionaries, determined to share the Gospel and see lives changed. Josh committed himself to two years of language school and became fluent in Xhosa so he could preach, disciple, and minister more effectively.”

IRS Extends Filing Deadline for Tennessee Residents

Knoxville, TN (WOKI) The Internal Revenue Service announces tax relief for the entire state of Tennessee affected by severe storms, tornadoes, flooding and more that began in early April.

The IRS says that Tennessee taxpayers will now have until November 3rd to file federal individual and business tax returns and make tax payments.

The IRS is offering relief to any area designated by the Federal Emergency Management Agency which means that individuals and households that reside or have a business in Tennessee’s 95 counties qualify for tax relief.

April 14, 2025 WASHINGTON — The Internal Revenue Service announced today tax relief for individuals and businesses in the entire state of Tennessee affected by severe storms, straight-line winds, tornadoes and flooding that began on April 2, 2025.

These taxpayers now have until Nov. 3, 2025, to file various federal individual and business tax returns and make tax payments.

The IRS is offering relief to any area designated by the Federal Emergency Management Agency (FEMA). This means that individuals and households that reside or have a business in Tennessee’s 95 counties qualify for tax relief. The current list of eligible localities is always available on the Tax relief in disaster situations page on IRS.gov.

Filing and payment relief

The tax relief postpones various tax filing and payment deadlines that occurred from April 2, 2025, through Nov. 3, 2025 (postponement period). As a result, affected individuals and businesses will have until Nov. 3, 2025, to file returns and pay any taxes that were originally due during this period.

This means, for example, that the Nov. 3, 2025, deadline will now apply to:

- Individual income tax returns and payments normally due on April 15, 2025.

- 2024 contributions to IRAs and health savings accounts for eligible taxpayers.

- Quarterly estimated tax payments normally due on April 15, June 16 and Sept. 15, 2025.

- Quarterly payroll and excise tax returns normally due on April 30, July 31 and Oct. 31, 2025.

- Calendar year corporation and fiduciary returns and payments normally due on April 15, 2025.

- Calendar year tax-exempt organization returns normally due on May 15, 2025.

In addition, penalties for failing to make payroll and excise tax deposits due on or after April 2, 2025, and before April 17, 2025, will be abated if the deposits are made by April 17, 2025.

The Disaster assistance and emergency relief for individuals and businesses page has details on other returns, payments and tax-related actions qualifying for relief during the postponement period.

The IRS automatically provides filing and penalty relief to any taxpayer with an IRS address of record located in the disaster area. These taxpayers do not need to contact the agency to get this relief.

It is possible an affected taxpayer may not have an IRS address of record located in the disaster area, for example, because they moved to the disaster area after filing their return. In these kinds of unique circumstances, the affected taxpayer could receive a late filing or late payment penalty notice from the IRS for the postponement period. The taxpayer should call the IRS Special Services toll-free number at 866-562-5227 to update their address and request disaster tax relief.

In addition, the IRS will work with any taxpayer who lives outside the disaster area but whose records necessary to meet a deadline occurring during the postponement period are located in the affected area. Taxpayers qualifying for relief who live outside the disaster area need to contact the IRS Special Services toll-free number at 866-562-5227. This also includes workers assisting the relief activities who are affiliated with a recognized government or philanthropic organization. Disaster area tax preparers with clients located outside the disaster area can choose to use the bulk requests from practitioners for disaster relief option, described on IRS.gov.

Additional tax relief

Individuals and businesses in a federally declared disaster area who suffered uninsured or unreimbursed disaster-related losses can choose to claim them on either the return for the year the loss occurred (in this instance, the 2025 return normally filed next year), or the return for the prior year (2024). Taxpayers have extra time – up to six months after the due date of the taxpayer’s federal income tax return for the disaster year (without regard to any extension of time to file) – to make the election. For individual taxpayers, this means Oct. 15, 2026. Be sure to write the FEMA declaration number – 3625-EM − on any return claiming a loss. See Publication 547, Casualties, Disasters, and Thefts, for details.

Qualified disaster relief payments are generally excluded from gross income. In general, this means that affected taxpayers can exclude from their gross income amounts received from a government agency for reasonable and necessary personal, family, living or funeral expenses, as well as for the repair or rehabilitation of their home, or for the repair or replacement of its contents. See Publication 525, Taxable and Nontaxable Income, for details.

Additional relief may be available to affected taxpayers who participate in a retirement plan or individual retirement arrangement (IRA). For example, a taxpayer may be eligible to take a special disaster distribution that would not be subject to the additional 10% early distribution tax and allows the taxpayer to spread the income over three years. Taxpayers may also be eligible to make a hardship withdrawal. Each plan or IRA has specific rules and guidance for their participants to follow.

The IRS may provide additional disaster relief in the future.

Taxpayers who do not qualify for disaster tax relief may qualify for reasonable cause penalty abatement. See Penalty Relief for Reasonable Cause for additional information.

The tax relief is part of a coordinated federal response to the damage caused by these storms and is based on local damage assessments by FEMA. For information on disaster recovery, visit DisasterAssistance.gov.

Reminder about tax return preparation options

- Eligible individuals or families can get free help preparing their tax return at Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE) sites. To find the closest free tax help site, use the VITA Locator Tool or call 800-906-9887 Note that normally, VITA sites cannot help claim disaster losses.

- To find an AARP Tax-Aide site, use the AARP Site Locator Tool or call 888-227-7669.

- Any individual or family whose adjusted gross income (AGI) was $84,000 or less in 2024 can use IRS Free File’s Guided Tax Software at no cost. There are products in English and Spanish.

- Another Free File option is Free File Fillable Forms. These are electronic federal tax forms, equivalent to a paper 1040, and are designed for taxpayers who are comfortable filling out IRS tax forms. Anyone, regardless of income, can use this option.

- MilTax, a Department of Defense program, offers free return preparation software and electronic filing for federal tax returns and up to three state income tax returns. It’s available for all military members and some veterans, with no income limit.

Congrats to Jay Hill, The Michelob Ultra “Better Than a Birdie” Golf Getaway Grand Prize Winner!

Update: Congraulations to Jay Hill, he won 4 tickets to the TPC Southwind Fed Ex St. Jude Championship August 9-10th in Memphis, 2 Michelob Ultra Golf Bags, and $1,000 gift card!

99.1 The Sports Animal Presents- The Michelob Ultra “Better Than a Birdie” Golf Getaway!

You could win 4 tickets to the TPC Southwind Fed Ex St. Jude Championship August 9-10th in Memphis, 2 Michelob Ultra Golf Bags, and $1,000 prepaid Visa card!

Listen to qualify from April 14th – May 15th on 99.1 The Sports Animal!

***If you are qualified, you will need to be present at Top Golf 11400 Outlet Drive on Thursday, May 15th. Check in is from 5p-6p and will cut off promptly at 6pm.***

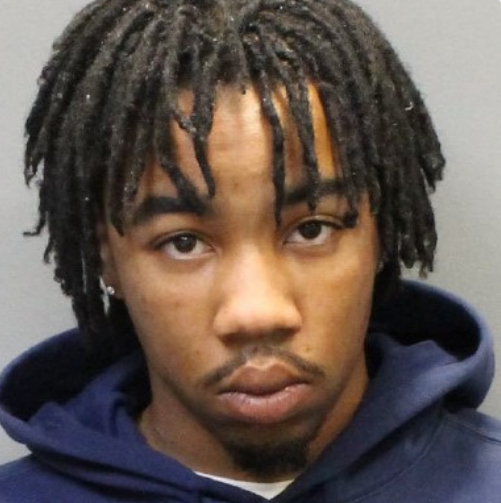

Knoxville Police Asking for Help to Find an Oak Ridge Man Wanted for Multiple Outstanding Warrants

Knoxville Police Department detectives are working to find 21 year-old Edward Prather of Oak Ridge.

Prather is wanted for multiple outstanding warrants, including two counts of aggrevated burglary and one count of felony vandalism, stalking and domestic assault.

If you know where he is please contact East TN Valley Crime Stoppers at 865-215-7165.

Tennessee Department of Education Releases Checklist to Receive State Money to Send Children to Private School

The Tennessee Department of Education has released a checklist for families interested in getting state money to send their children to private school.

The checklist centers on the controversial Education Freedom Scholarship Program, also known as the school voucher bill which uses state dollars to families interested in private school. That bill passed at the start of this year during a special session.

Those picked to receive a scholarship will get $7,295 to go towards enrolling in private school. The Tennessee Department of Education will award 20,000 scholarships with two types of eligibility, Universal Scholarships Open to any eligible student Quali ed Scholarships Reserved for eligible students based on income, IEA eligibility, or ESA eligibility .

Please go to https://www.tn.gov/education/efs.html to view the complete checklist.

Tennessee Department of Education Releases Checklist to Receive State Money to Send Children to Private School

The Tennessee Department of Education has released a checklist for families interested in getting state money to send their children to private school.

The checklist centers on the controversial Education Freedom Scholarship Program, also known as the school voucher bill which uses state dollars to families interested in private school. That bill passed at the start of this year during a special session.

Those picked to receive a scholarship will get $7,295 to go towards enrolling in private school. The Tennessee Department of Education will award 20,000 scholarships with two types of eligibility, Universal Scholarships Open to any eligible student Quali ed Scholarships Reserved for eligible students based on income, IEA eligibility, or ESA eligibility .

Please go to https://www.tn.gov/education/efs.html to view the complete checklist.

An Early Morning Hit and Run Crash in Halls Leaves One Person Injured

An investigation is underway following an early morning (Thursday) hit and run accident in Halls.

Rural Metro Fire crews called to Maynardville Highway near East Emory Road and found one damaged car in the road while the other vehicle had fled the scene.

The driver of the vehicle at the scene was taken to the hospital with non-life threatening injuries.

If you have any information, please contact authorities.