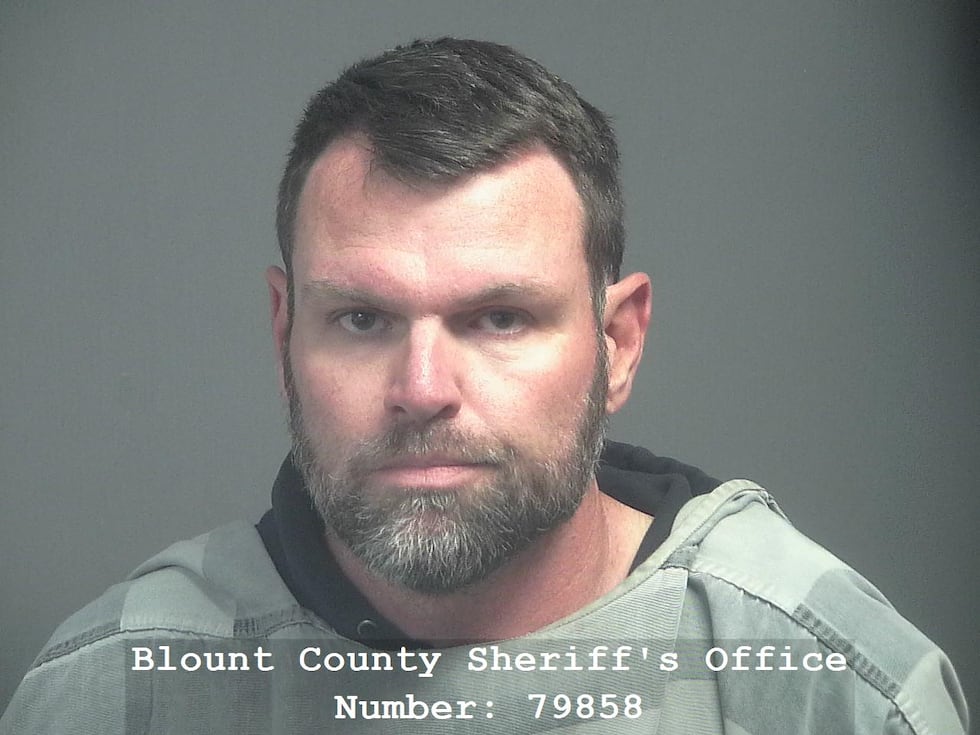

MARYVILLE, Tenn. (WVLT) – The Blount County District Attorney behind the sentencing of a former gym teacher accused of inappropriately touching students released a statement explaining the laws as they currently stand and his reasoning behind the charges.

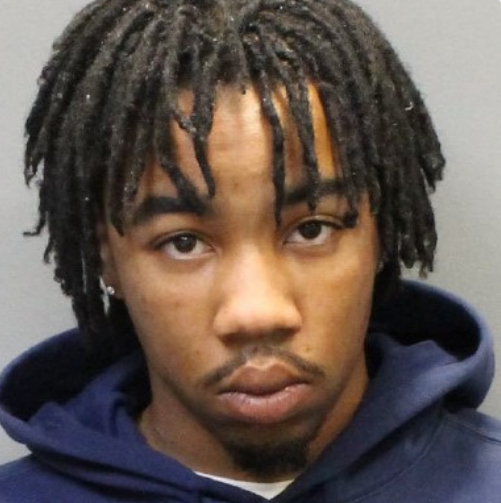

Joseph Dalton is a former gym teacher who was recently sentenced for several charges of assault against elementary school students.

Dalton worked for several elementary schools in Blount County and faced multiple complaints from parents and students who said he assaulted them physically.

The former teacher was sentenced Wednesday to six months of supervised probation after pleading guilty to assault in September.

There has been an outcry in the Blount County community, and Fifth Judicial District Attorney General Ryan Desmond, who was over Dalton’s prosecution, released a statement explaining how the case developed, the laws currently in place and his reasoning behind the charges.

Desmond said he became aware of an incident involving a young student in early 2023, and after an extensive review of surveillance video from every class Dalton had participated in, investigators found “multiple concerning incidents where the teacher had physical contact with students which we deemed to be inappropriate.”

Currently, Desmond said Tennessee’s criminal laws on sexual battery require contact with the “intimate parts” of a victim. However, none of the videos or accusations showed that Dalton had touched any of the students in that way, meaning that while his actions were concerning and inappropriate, it did not qualify as sexual battery or any other sexual offense under state law.

The DA said his office was then faced with the question of closing the case and investigation because the conduct did not amount to sexual battery, but he said closing it was “unacceptable.”

After researching the law, Desmond said the only criminal offense that fit the facts and evidence was assault through the “offensive touching” of another, which is a Class B misdemeanor and carries a maximum punishment of six months.

Desmond said he found it to be worth it to prosecute the charges despite the sentence being minimal because “the alternative was to do nothing.” He said if more serious charges had been supported with evidence that they would have been pursued, but that was not the case.

Desmond added that he doesn’t disagree with people’s belief that the sentence is insufficient, saying he would support an effort to amend the law to address scenarios like this.

He said the law as it currently exists is “clearly insufficient,” but he made the decision that some action had to be taken and said he stands by that decision. Dalton was sentenced to the maximum punishment of six months of supervised probation.

Desmond is not the only official to speak out about the case. Blount County Mayor Ed Mitchell called out the school district’s administration and said the current laws need to be changed.

State records obtained by WVLT News show Dalton still has a valid teaching license even after being sentenced on the charges.

Below is Desmond’s full statement on the case:

I have always believed in honesty and transparency. So while I understand that it may be difficult for some to accept, it is my sincere hope that being straightforward and open will help most understand what has transpired. The mission of the District Attorney’s Office is to seek justice, protect the community, and, in all instances, try to do the right thing.

In the later parts of 2023, I became aware of an incident where a young student at one of our local schools felt like one of their teachers was acting in an inappropriate manner. These allegations were the first time I had ever heard of this teacher.

Shortly thereafter, individuals came to me to express concerns that the teacher in question had been the subject of similar allegations numerous times in the past. I directed my criminal investigator to pull all available surveillance video from every class the teacher had participated in for the entire school year to that point. After careful review, we located multiple concerning incidents where the teacher had physical contact with students which we deemed to be inappropriate. We notified the parents of the students involved and continued the investigatory process of collecting statements and any possible related evidence.

It is important to note at this point, that the Tennessee criminal laws on sexual battery require contact with the “intimate parts” of a victim. None of the videos or subsequent evidence for these allegations showed that the teacher in question had touched the “intimate parts” of any of the students involved. While the teacher’s conduct was concerning and inappropriate, it did not qualify as sexual battery or any other sexual offense under current Tennessee law.

We then faced a question, if the conduct did not amount to sexual battery, should the case and investigation then be closed? I found this answer to be unacceptable.

Instead, we carefully researched the law and found the only criminal offense that fit the facts and evidence before us. That criminal offense was assault through the “offensive touching” of another. It was our conclusion that while the conduct did not meet the threshold of sexual battery, it was contact that was offensive to a reasonable person, and certainly to the parents of these children.

Assault by offensive touching under Tennessee law is a Class B misdemeanor. The maximum punishment for a B misdemeanor is 6 months.

We were again faced with a choice. Was it worth it to prosecute charges knowing the sentence would be minimal? The alternative was to do nothing. I was elected to protect the citizens of our community, and the right choice was clear. Considering past efforts by the school system to curtail this teacher’s behavior had clearly not been effective, doing nothing was not an option I could accept.

I made the decision to charge this teacher with five counts of offensive touching assault. This decision was not made lightly. It was made knowing full well that many would think the charges and the sentence would be woefully insufficient. We can only do what the law allows, and the job of my office is to apply the facts and evidence to the law. If there were more serious charges which were supported by the evidence, they would have been pursued. That was not the case.

I understand people believe the sentence for these crimes is insufficient. I do not disagree. I would certainly support any effort by the legislature to amend the law to address scenarios wherein a person in a position of trust has inappropriate contact with children in their care.

The law for these crimes, as it currently exists, is clearly insufficient. Despite that inadequacy, when faced with this issue I ultimately made the decision that some action had to be taken. I stand by that decision.Fifth Judicial District Attorney General Ryan Desmond

Story courtesy of WVLT